Hyundai Motor Group has reached the position of the third-largest automaker globally in terms of unit sales. Hyundai Motor Group, which includes Hyundai and Kia, surpassed the Renault-Nissan-Mitsubishi Alliance and GM, ranking third in global sales behind Toyota and the Volkswagen Group.

Hyundai Was Once Called a “Copycat”

Hyundai has been referred to as a “copycat” in the past due to its perceived imitation of other successful automakers. In the 1990s and early 2000s, the company was criticized for producing cars that closely resembled those of other manufacturers, both in terms of design and features.

For example, Hyundai’s first attempt at a luxury sedan, the Hyundai Grandeur, was heavily criticized for its similarity to the Mercedes-Benz S-Class. Similarly, Hyundai’s first SUV, the Hyundai Santa Fe, was criticized for its resemblance to the Ford Explorer.

These criticisms led to Hyundai being labeled as a “copycat” in the industry.

Hyundai’s Foray into the Global Automotive Market Shaped by Giugiaro

Giorgetto Giugiaro is one of the most iconic names in car design, and he played a significant role in shaping the early history of Hyundai’s foray into the global automotive market. Giugiaro was the one who styled the exterior of the original Hyundai Pony, which helped ensure that the car looked modern and contemporary, despite coming from a nation that was not known for building cars.

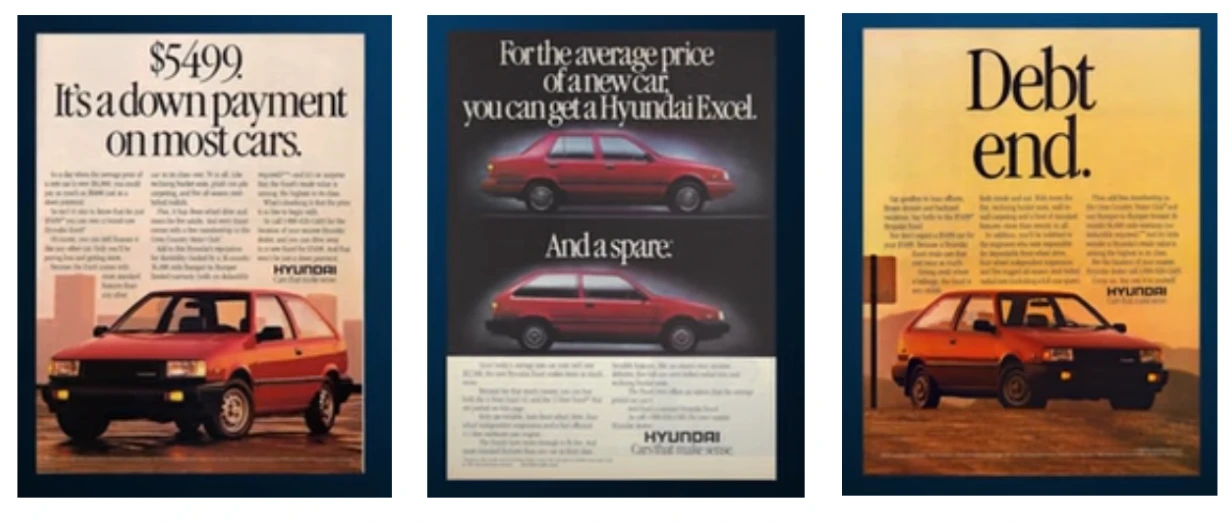

The successor to the Pony, the Hyundai Excel, was also designed by Giugiaro and was the first car sold by Hyundai in the US, debuting in 1986. The Excel was known for its low price, which made it accessible to a wide range of consumers. However, as the speaker notes, “You got what you paid for” – the car was cheap in every sense of the word, and its quality and reliability did not match up to the Japanese brands that were popular at the time.

Despite these shortcomings, the Excel was a staggering success, thanks in large part to its iconic designer and the fact that it was an affordable car from an Asian country at a time when Americans were besotted with the Japanese reputation for quality and reliability. The Excel sold 100,000 units in its first seven months and nearly 169,000 for the full year, making it one of the strongest US launches by an import carmaker ever.

Hyundai’s Early Struggles in the US Market and the Turnaround Strategy

Pretty quickly, customers realized that Hyundais weren’t built to the standards of Japanese cars. By 1998, Hyundai’s annual US sales had dropped to about 90,000 vehicles.

The top management at Hyundai realized the importance of quality and safety, and there was a huge focus on improving the quality. Hyundai’s chairman and CEO at that time, Chung Mong Koo, adopted a fast-follower strategy, adopting the best practices of leading car manufacturers, which at the time meant Japanese automakers like Toyota and Honda.

Under Chung Mong Koo, Hyundai ruthlessly benchmarked its quality against its neighbors. They designed a lot of automation in the assembly line to do quality checks at the end of the assembly line. They kept good records on quality defects, which let them diagnose and fix issues quickly. By early 2000, Hyundai’s quality level became very comparable to US big three cars and the Japanese cars.

Hyundai’s turnaround strategy was not just about improving quality. They also invested heavily in research and development, which led to the launch of innovative cars like the Hyundai Sonata and Santa Fe. The company also focused on building a strong brand image, investing in marketing and advertising campaigns that emphasized Hyundai’s commitment to quality and safety.

Hyundai sought to reinforce its commitment to quality by offering a comprehensive warranty program. The company launched a ten-year, 100,000-mile powertrain warranty, one of the strongest warranties that anybody had ever heard of, a move that generated significant attention and interest. This bold initiative helped to convey to consumers, particularly in the United States, that Hyundai was serious about quality and was committed to providing reliable and durable vehicles. By offering such a comprehensive warranty, Hyundai was able to differentiate itself from competitors who offered shorter or less comprehensive warranties, and to position itself as a brand that could be trusted to deliver high-quality vehicles. This helped to shift the perception of Hyundai as a producer of cheap, poorly made cars, and to establish it as a serious player in the automotive market.

The turnaround strategy was a success. By 2005, Hyundai’s US sales had doubled from the previous year, reaching over 400,000 vehicles.

Hyundai’s Strategic Acquisition: Rescuing Kia and Forming the Hyundai Motor Group in 1998

In the wake of the 1997 Asian financial crisis, many South Korean companies, including carmakers, faced collapse. Daewoo was one casualty, and Kia was another until Hyundai stepped in by buying a 51% stake in the company. The acquisition was strategic as Hyundai aimed to boost sales in Europe and the US and repair its tarnished image. The deal was valued at $886 million, with Hyundai proposing that Kia’s creditors forgive 80% of its $7 billion debt.

The acquisition resulted in the formation of the Hyundai Motor Group, which allowed the two companies to share technology platforms and top staff. To strengthen its position, Hyundai brought in heavy hitters from respected European brands, including Peter Schreier from Volkswagen Group, Luc Donckerwolke previously at Bentley, Lamborghini, Audi, and Skoda, and Albert Biermann from BMW’s high-performance M division. Over time, Hyundai’s stake in Kia has been reduced to about 33%, but the two companies continue to collaborate on a wide range of projects, sharing resources, and expanding their global reach.

Hyundai has undergone a significant transformation in recent years, shifting from being known for producing cheap cars to becoming a leader in innovative design and technology. The company’s product offerings have become more diverse and unique, with models like the Veloster N and various SUVs that stand out in the market. The design across all three brands, Hyundai, Kia, and Genesis, is distinct and appealing, making them attractive to consumers.

However, Hyundai has faced its fair share of missteps and obstacles. The high-end Genesis brand struggled at first due to a limited lineup of sedans in a market that was turning toward SUVs. Additionally, millions of Hyundai cars were recalled over fire risk, and the company faced a rash of thefts due to a lack of engine immobilizers. These issues tarnished the company’s reputation, but Hyundai has taken steps to address them.

Hyundai has spent hundreds of millions of dollars developing a fix for the fire risk issue, providing clinics, stadiums, and parking lots with hired technicians to avoid overwhelming dealers. The company has also been proactive in addressing the theft issue, implementing a software update to address the lack of engine immobilizers and providing anti-theft clinics for consumers. These efforts have been successful, with positive sentiment and a decline in the number of anti-theft cases.

The company is also facing a labor movement, with the United Auto Workers union turning its attention toward foreign automakers with nonunion US factories. The union claims that more than 30% of workers at Hyundai’s Montgomery, Alabama, plant have signed union cards, but Hyundai has not confirmed these numbers. The company plans to raise wages by 25% through 2028 and has the support of local and state authorities. So far, workers have chosen not to be unionized.

Hyundai is also hampered by trade policies, with the federal EV tax credit only fully available to American-made cars. In 2022, the company made a significant investment totaling $10 billion, aimed at expanding its operations in the United States. However, when the Inflation Reduction Act was introduced, Hyundai’s plans hit a roadblock as its vehicles did not qualify for the associated benefits. Undeterred by this setback, Hyundai has redoubled its efforts, doubling down on its investments in the US market. This includes the establishment of a massive $12.6 billion plant near Savannah, Georgia, encompassing vehicle assembly as well as two battery manufacturing facilities.

Hyundai has also kept up with investments in hybrids, plug-in or otherwise, as automakers such as Toyota have argued that they are a better solution for electrification in the short term. The company is taking a flexible approach, ready to react and be flexible should conditions change. Hyundai has the world’s largest share of hydrogen vehicles, a powertrain that has not taken off in passenger cars and has been ridiculed by the likes of Tesla CEO Elon Musk. Nevertheless, Hyundai continues to invest in this technology, with a new factory and innovation center in Singapore that is highly automated and uses what it calls a cell-based production system.

Hyundai is also taking risks in distribution, collaborating with Amazon on a pilot project selling cars through its platform. The online sales are going to happen no matter what, with or without Amazon, and with or without Hyundai, because this is the trend for everybody. Hyundai is not imitating Tesla or Toyota or US companies because, in this new industry, there is no leader, which is totally different from past industries.

Management under Chung Mong koo was top-down, laser-focused on a clear goal of improving Hyundai’s status in quality rankings. Five years ago, if Munoz thought he would be where the company is today, he was not as optimistic. He thought they were going to make progress, but he thinks they made way more progress than everybody expected.

Hyundai Motor Group has solidified its position as the third largest automaker globally in terms of volume. The company has come a long way since the 1990s when it grappled with low sales and a poor reputation for quality. Today, its three automotive brands, Hyundai, Kia, and Genesis, are giving well-established competitors a run for their money, earning numerous awards along the way.

Although Tesla continues to lead the electric vehicle (EV) industry, Hyundai and Kia are making significant strides in the sector. However, Hyundai’s ambitions extend beyond EVs, with the company investing heavily in robotics, autonomous driving, and flying taxis, areas that many of its competitors have abandoned.

Despite its successes, Hyundai has faced several challenges. For instance, a rise in thefts of its vehicles has become a significant concern. Additionally, millions of its cars are at risk of catching fire, a safety issue that the company is working diligently to address. The looming possibility of a union push and a recent snub from the U.S. government are other obstacles that Hyundai must overcome to maintain its position in the highly competitive automotive industry.